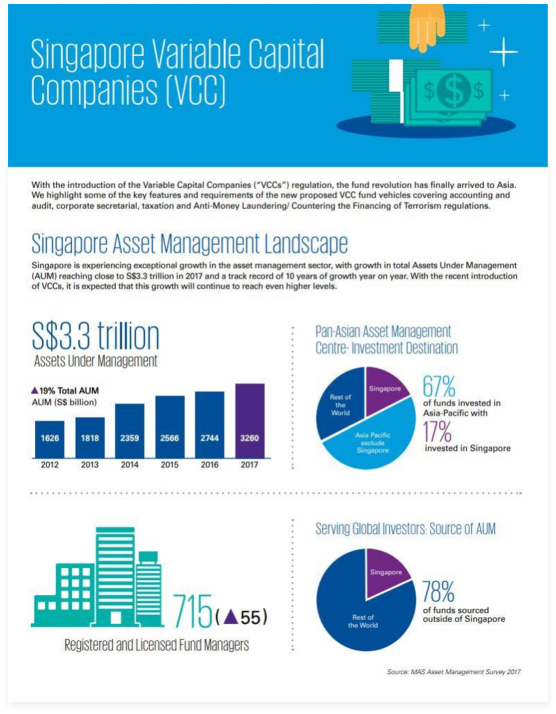

With a Capital Market Services license for Fund Management, JIA is excited to be a part of the growth and popularity of Variable Capital Companies (VCC) launched by the Monetary Authority of Singapore (MAS) and the Accounting and Corporate Regulatory Authority (ACRA) in early 2020.

The VCC is a new corporate structure that can be used for a wide range of investment funds and provides fund managers greater operational flexibility with enhanced cost savings, encouraging more funds to be domiciled in Singapore and enhance the city’s value as an international fund management centre.

JIA is pleased to offer our clients a wide range of investment opportunities through VCCs and as testimony to the value of this new corporate vehicle, have launched our own VCC sub-fund “JIA Australian Opportunities Fund” in Singapore for Accredited Investors since Q4 2020.

As a Fund Management Licensee, JIA is excited to participate in the Variable Capital Companies (VCC) launched by The Monetary Authority of Singapore (MAS) and the Accounting and Corporate Regulatory Authority (ACRA) in early 2020.

The VCC is a new corporate structure that can be used for a wide range of investment funds and provides fund managers greater operational flexibility with cost savings. It will encourage more funds to be domiciled in Singapore and enhance the city’s value as an international fund management centre.

We are looking forward to offer our clients a wider range of investment opportunities through this new platform.

JIA is pleased to have launched our new VCC sub-fund “JIA Australian Opportunities Fund” here in Singapore for Accredited Investors in 4Q 2020.

Key features of vCC

Variable Capital Structure - Flexibility in share issuance & dividends payments

- The value of paid-up capital of a VCC is deemed to be equal to its Net Asset Value.

- This provides flexibility in the issuance and redemption of shares.

- Dividends can also be distributed out off capital or profits.

Umbrella Structure - Economies of Scale

- VCCs can be operated as a single standalone or umbrella structure.

- It is permissible to have open-ended and close-ended sub-funds within an umbrella.

- Unlike a fund setup that utilizes special purpose vehicles, operating functions of a VCC (i.e. board of directors, administrative, accounting, compliance) can be centralized at the umbrella fund level, providing economies of scale and cost savings.

Single Shareholder

- VCCs can have a single shareholder or hold a single asset.

- This allows for the application of VCCs as a Master-Feeder structure.

Key features of vCC

Privacy

- VCC addresses privacy concerns of shareholders and investors.

- VC’s investor/shareholders’ registers, filing for financial statements and tax reporting will not be made publicly available.

Tax Incentives

- A These tax incentives are designed for funds managed by licensed fund management companies like JIA.

- Once approved by MAS, specified income derived from what are known as ‘designated investments’ within these VCC funds would be then exempt from tax.

- The tax incentives are outlined in section 130 and 13U under the Singapore Income Tax Act.

Segregation of Assets & Liabilities across sub-funds

- Each sub-fund of an umbrella VCC operates as a cell in which its assets and liabilities are segregated and ringfenced from those of the other sub-funds.

- This is particularly useful for fund managers looking to run various fund strategies or Single-Family

Offices looking to segregate their portfolios across different asset classes.

Singapore vCC vs

traditional offshore centre

System of Law & Governance

- Singapore has a solid global reputation for its strong and established governance structure.

- Stable climate politically, economically and operationally relative to many other offshore fund centres.

Comitment to International Reporting Standards & Requirements

- Singapore has a strong commitment to implement the Common Reporting Standards (CRS) - an internationally agreed standard for automatic exchange of financial account information between jurisdiction for tax purposes – to combat tax evasion and ensure tax compliance

Robust & Effective Regulation

- Singapore has robust supervision framework and effective regulations including Anti Money Laundering (AML and Countering the Financing of Terrorism (CFT) laws.